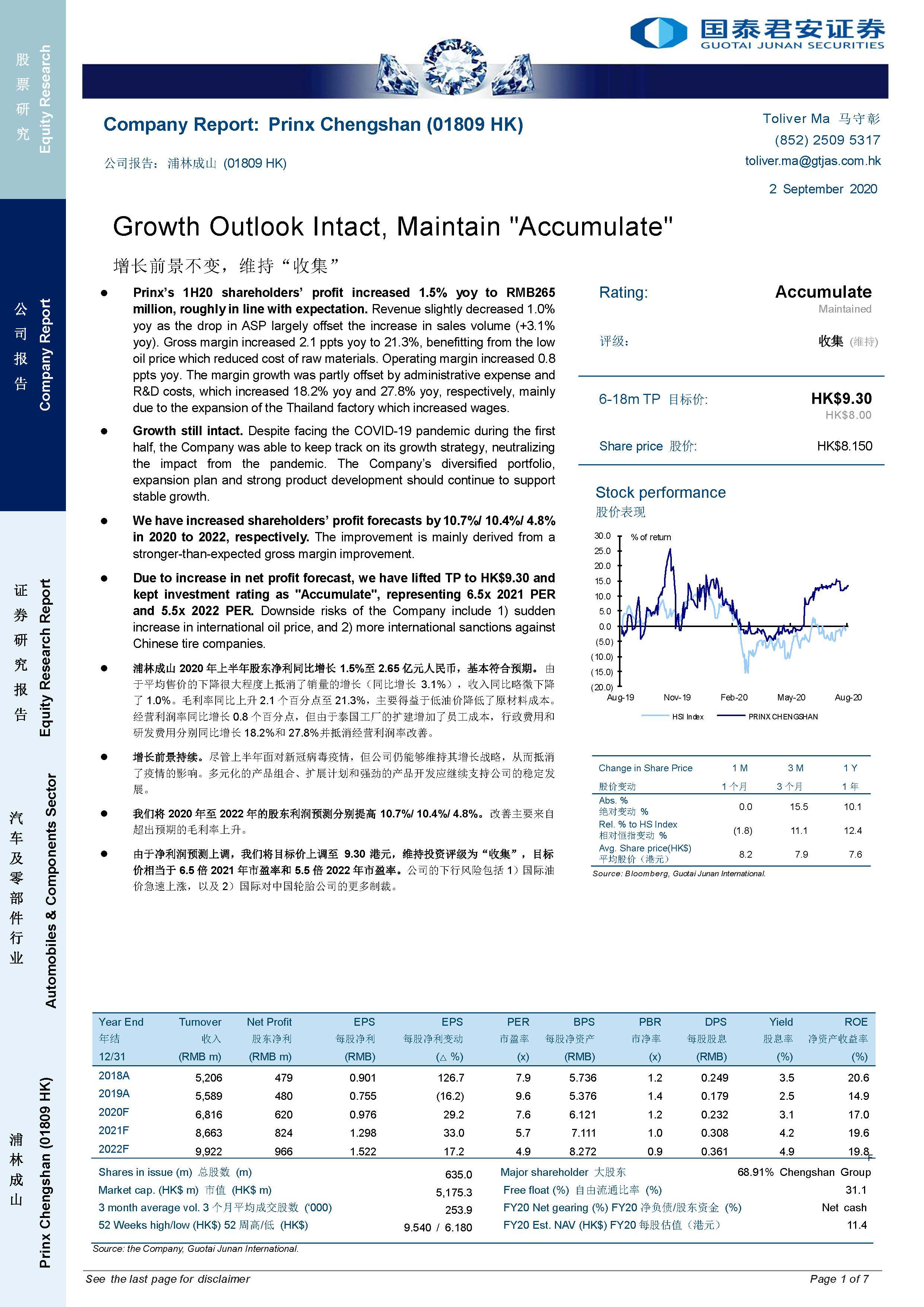

Prinx's 1H20 shareholders' profit increased 1.5% yoy to RMB265 million, roughly in line with expectation. Revenue slightly decreased 1.0% yoy as the drop in ASP largely offset the increase in sales volume (+3.1% yoy). Gross margin increased 2.1 ppts yoy to 21.3%,benefitting from the lowoil price which reduced cost of raw materials. Operating margin increased 0.8 ppts yoy. The margin growth was partly offset by administrative expense and R&D costs, which increased 18.2% yoy and 27.8% yoy, respectively, mainly due to the expansion of the Thailand factory which increased wages.

Growth still intact. Despite facing the COVID-19 pandemic during the first half, the Company was able to keep track on its growth strategy, neutralizing the impact from the pandemic. The Company's diversified portfolio,expansion plan and strong product development should continue to support stable growth.

We have increased shareholders' profit forecasts by 10.7%/ 10.4%/ 4.8% in 2020 to 2022, respectively. The improvement is mainly derived from a stronger-than-expected gross margin improvement.

Due to increase in net profit forecast, we have lifted TP to HK$9.30 and kept investment rating as "Accumulate", representing 6.5x 2021 PER and 5.5x 2022 PER. Downside risks of the Company include 1) sudden increase in international oil price, and 2) more international sanctions against Chinese tire companies.